tax tips from a former irs agent

We did the time behind the scenes, now you get the benefit of that first-hand experience.

Why Relationships Still Matter in Tax—and Why the Industry Is at Risk Without Them

In an industry racing toward scale, speed, and automation, Gabe’s message is quietly radical: relationships aren’t a soft skill in tax—they’re the foundation. And for clients who want to thrive, not just comply, choosing the right relationship may be the most important tax decision they make.

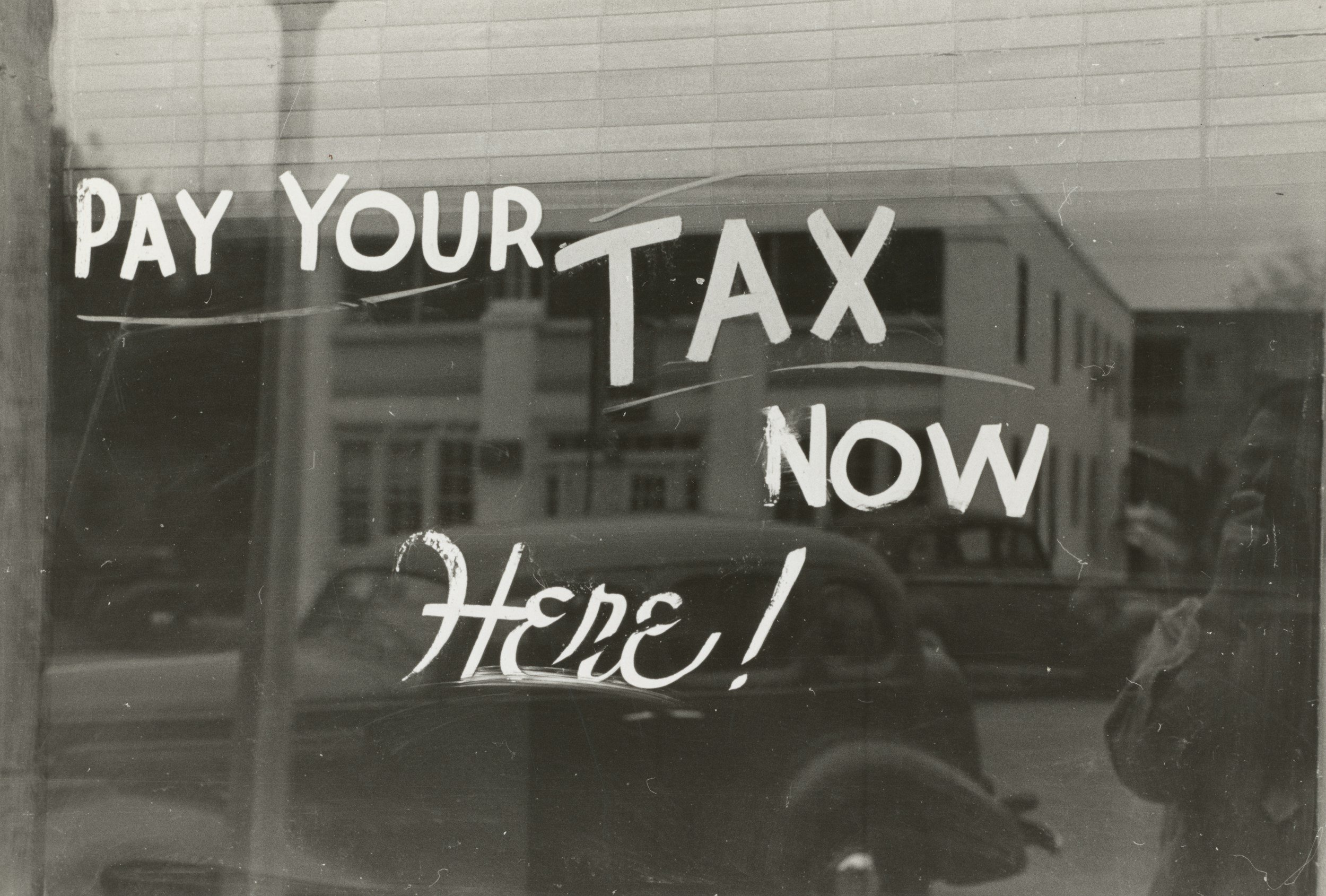

Important 2026 tax dates

Here is your quick guide to upcoming federal tax deadlines, the forms you’ll probably need, and who’s responsible for filing. It covers individuals, businesses, and common entity types.

inside the IRS: Why the System Is Broken

This blog breaks down the real reasons the IRS struggles to function effectively—from outdated technology and weak internal incentives to inconsistent audit quality and a reliance on fear-based compliance. Learn what actually happens inside the agency, why so many taxpayers lose audits, and how understanding IRS culture can dramatically improve your tax strategy and defense.

the real estate playbook

Investing in real estate offers tangible tax benefits. The key to unlocking their income potential is to apply strategic, proactive tax strategies. The Real Estate Playbook shows you what successful short-term rental strategy means.